Equity Upside: Equity appreciation upon refinance or sale boosts overall return.

Attractive Returns: Apartments remain stable during recessions, as well as during stable and rising interest rate environments.

Cash Flow: Receive steady cash flow through annualized distributions, paid out quarterly.

Pass-Thru Depreciation: A tax benefit tool which allows the Investor to utilize a passive “loss” from depreciating improvements to offset other passive income. Investors are strongly encouraged to consult a tax advisor.

Portfolio Diversification: Adding investment real estate to your portfolio will help offset the volatility of other high-risk investments, such as stocks and bonds, leading to increased stability in your investment portfolio.

Own Real Estate Without Management Headache: Teak Ridge outsources property management to well-known property management companies to ensure tenant satisfaction.

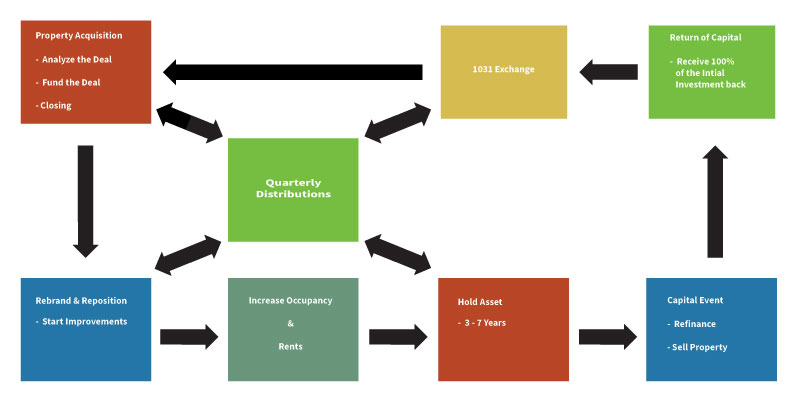

Acquire under performing, undervalued multifamily assets, and reposition with high quality amenities to increase occupancy and rental rate.